💵 Expenses Page

“Track every cost — from restocking to rent, logistics, and beyond.”

🎯 Purpose of This Page

The Expenses Page is designed to help you record and manage any cost that doesn't directly come from a purchase bill or product sale.

You use it to:

- Record operating costs (rent, utilities, salaries)

- Track spending unrelated to stock (e.g., equipment repair)

- Add supplier or customer-linked expenses

- Maintain transparency in clinic, store, or company spending

- Export expense records for accounting or audit

✅ This page works like a simplified ledger of outflows — every money-out event that matters.

👥 Who Uses This Page?

- Finance staff recording bills or payment vouchers

- Store officers logging shipping fees or losses

- Procurement staff recording vendor charges

- Hospital administrators tracking patient-related expenses

- Clinic managers logging salary, fuel, or repair expenses

🧾 What You Can Record

| Expense Type | Example Entries |

|---|---|

| 📦 Shipping | Courier fee for emergency delivery from supplier |

| 🧰 Maintenance | Cost to repair faulty storage fridge |

| 🏠 Rent | Monthly space rental fee for storage unit |

| ⚡ Utilities | Electricity or internet payment |

| 👥 Salaries | Payments to temp workers or contracted staff |

| 📃 Other | Donation payouts, insurance fees, etc. |

🛠️ What You Can Do On This Page

| Feature | Description |

|---|---|

| 🔎 Search Bar | Search expenses by keyword (e.g., “Internet”) |

| 📅 Date Filters | Filter by “Today,” “Last Week,” “This Month,” etc. |

| 👤 Link to Customer | Optional – tag an expense to a specific customer (e.g., refunds) |

| 🧾 Description Field | Clearly explain the reason for expense |

| 💵 Amount Field | Record exact value spent |

| 🧑 User Tagging | System logs which user recorded the expense |

| 📄 Print / Export | Download or print the expense sheet |

🧰 Example Workflow: Logistics Cost

- You pay $150 for express shipping of emergency insulin.

- Open Expenses Page

- Click Add New

- Enter:

- Description: “Express shipping – insulin”

- Amount: 150

- Date: Today

- Save record

- ✅ Print or export later for reimbursement/audit

📈 Example: Monthly Report

The finance team wants to know how much you’ve spent this month outside of purchases.

- Filter: This Month

- View the expense list and total at the bottom

- Click Export CSV

- Submit file with monthly finance report

📬 Link to a Customer (Optional)

In scenarios where you’re refunding a customer or paying something on their behalf:

- Use the Customer field to tag the person

✅ This helps track all spend related to a single customer.

🧠 Useful for:

- Refunds

- Charity support

- Donated goods or grants

🖨️ Export & Print

At any point, you can:

- Export by month, user, or keyword

- Print a receipt or voucher-like sheet

- Store hard copies or attach to physical finance files

🧠 Best Practices

- Add clear, specific descriptions

- Encourage staff to tag users so actions are traceable

- Review expenses weekly or monthly

- Use filters to isolate by customer, date, or keyword

- Use the exported file as part of your bookkeeping or audit trail

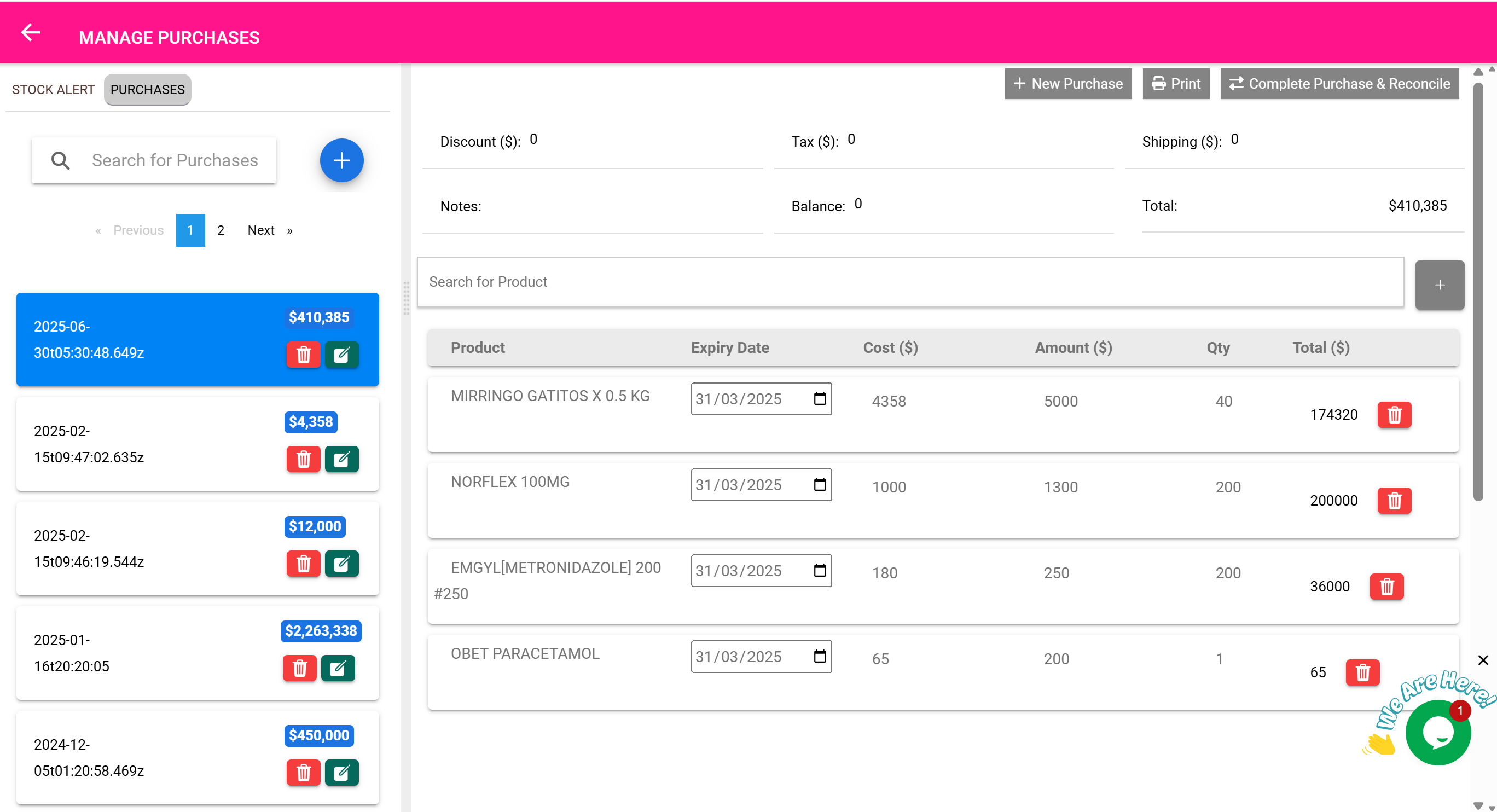

🔁 Purchases Are Automatically Tracked as Expenses

Every time you complete a purchase order (via the Purchases Page), the system automatically logs it as an expense entry.

This means:

- You don’t need to manually add the cost of purchased items to the Expenses Page.

- The cost of goods purchased (including tax and shipping) is captured under supplier-linked expense records.

- These appear in your expense exports and totals — helping you track both inventory costs and operating costs from a single place.

🧠 Example: Automatic Purchase Expense

You purchase $500 worth of antibiotics from “ABC Pharma” and mark the purchase as completed.

A new expense record is automatically created in the system. It includes:

- Supplier: ABC Pharma

- Amount: $500

- Description: “Purchase – Antibiotics”

- Date and user who performed the transaction

✅ It becomes visible in financial summaries and exports from the Expenses Page.

📌 Why This Matters

- Ensures no cost is missed when calculating operational expenditure

- Gives a complete financial overview — from purchases to utilities, logistics, and rent

- Helps the finance department reconcile spending against inventory movement